Surprises in Prices: Facts, Determinants, and Effects

Abstract

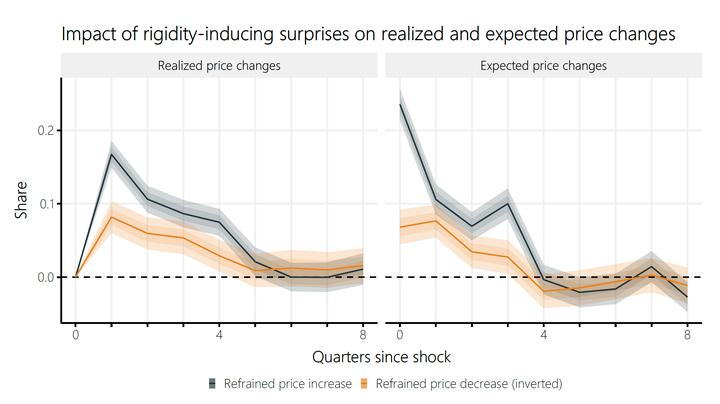

This paper examines the determinants of firms' price expectation errors and their effects on both price setting and inflation dynamics. The analysis differentiates between two types of surprises: those prompting price adjustments despite the absence of anticipated changes (termed flexibility-inducing) and those failing to induce price adjustments despite expectations of changes (termed rigidity-inducing). Survey data for Swiss firms reveals remarkable frequencies and cyclicality in price surprises, with flexibility-inducing surprises dominating: More than half of all price changes materialize as unanticipated adjustments from the prior quarter. Surprise responsiveness to news and predictability through firm-specific factors, profitability and competitive conditions, in particular, challenge the full-information rational expectations hypothesis. At the micro level, firms’ pricing decisions display significant and asymmetric responses to surprise shocks. At the macro level, the frequency of flexibility-inducing surprises emerges as a stronger driver of inflation variations than the frequency of anticipated price changes.